CBDCs or central bank digital currencies are growing in importance and interest in their adoption is becoming more widespread globally. However, these advances do not seem to be happening at a good pace in the United States. According to a report from the Bank of America (BAC), a digital dollar is unlikely to see the light of day in the near term.

Although the Federal Reserve (Fed) is focused on studying CBDCs, it has not yet made progress in its issuance and, according to analysts, it will not do so without prior approval from the executive branch and Congress.

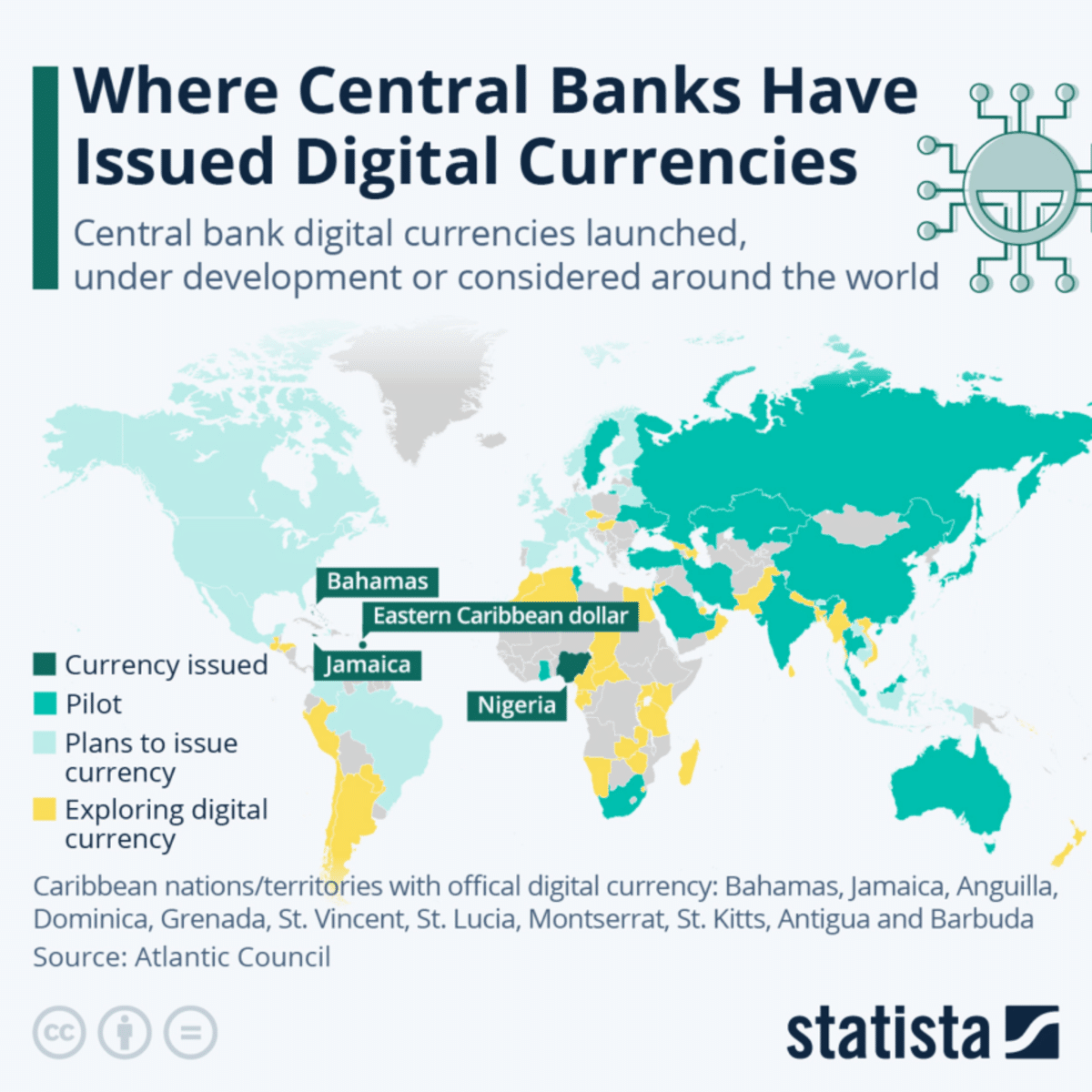

CBDCs are gaining momentum around the world

From Bank of America, they highlighted the importance for the United States to study the adoption of CBDCs, as their exploration around the world has accelerated in recent years. In fact, it is driven by central banks which represent 67% of the world’s nations and 98% of global GDP.

The progression of digital currencies is accelerating and becoming strong among the central banks of a large number of countries. In Latin America, the incursion is vast and actually stands out compared to the rest of the world. This was detailed in a mid-year report from the International Monetary Fund (IMF).

“Only two countries (Costa Rica and Panama) out of the 17 surveyed said they were not working on a CBDC. Half were considering both a retail and wholesale CBDC.

In turn, among the countries moving towards this adoption, the Swiss National Bank (SNB) has launched a wholesale CBDC test project, in partnership with SIX Digital Exchange (SDX) and six commercial banks. This is a significant advancement for future development, being the most advanced to date in this type of asset.

Bank of America highlighted the risks associated with CBDCs

Thinking about including a digital dollar also means exposing yourself to certain risks, which is why you must consider the possible permeabilities that this could entail. Well, CBDCs are very useful as an official currency for domestic and international payments and would support a country’s monetary policy, but they should be evaluated with caution.

In its report, Bank of America suggests that these digitized versions of official currencies could prove to be direct competitors to traditional bank deposits, triggering bank runs and weakening monetary sovereignty, thereby triggering international tensions.

Americans are skeptical

At least that’s what the data collected by Statista indicates, where only 1 in 4 Respondents said they would be interested in using the digital dollar if it were issued by the Fed. It is important to note that at the time the study was conducted, the topic was not widely publicized.

Another survey, carried out by the company Trezor, determined that Americans, English and Canadians fear the adoption of national digital currencies. And above all, that these bring greater control by governments over their investments, visualizing a possible loss of financial freedom.

Josef Tětek, Bitcoin analyst at Trezor, said: ““It’s clear that the vast majority of people are not comfortable with financial authorities having the kind of powers that a CBDC could grant them.”

The world appears to be waking up to the transformative potential that CBDCs could represent, as evidenced by the initiative taken by many of the world’s leading central banks. A challenge that requires time and overcoming many obstacles before taking a course.

Similar Articles:

“Entrepreneur. Amateur gamer. Zombie advocate. Infuriatingly humble communicator. Proud reader.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/A5W2WBP7NFEZHBE73JOUFHDR2M.jpg)